Products You May Like

NEW YORK—Institutional investors, the backbone of the commercial real estate industry, remain committed to the sector. However, per new findings from Hodes Weill & Associates and Cornell University’s Baker Program in Real Estate’s annual Institutional Real Estate Allocations Monitor, the pace of target allocation year-over-year growth is slowing.

In 2019, institutions reported an average target allocation to real estate of 10.5%, marking the sixth straight year of rising target allocations since the monitor launched in 2013.

However, 10 bps represents the lowest annual change in six years, during which time the annual change ranged from 20 bps to 40 bps. The 10 bps increase implies the potential for an additional $80 to $120 billion of capital to be allocated to real estate over the coming years, according to the report, which surveyed 212 institutional investors from 24 countries. The survey represents institutions with over $12.3 trillion in total assets and real estate assets of approximately $1.1 trillion.

Looking forward to 2020, 24% of institutions report that they expect to increase target allocations over the next 12 months, down slightly from 27% in the prior year. Again, the pace of growth appears to be moderating, as these institutions expect to increase targets by only 10 bps in 2020. Approximately 69% of institutions intend to hold their allocations flat over the next 12 months up from 65% as reported in last year’s report.

The increase is expected to be led by institutions in the Americas and APAC, each of which are forecasting an increase of 20 bps. While EMEA-based institutions are expecting to hold target allocations flat over the next year, the region reported the highest average target allocation to real estate in 2019, at 11.3%.

The monitor notes that these trends appear to be indicative of late market cycle sentiment. “However, it is important to note that institutions remain broadly active on a global basis in allocating capital to real estate strategies and products and, as such, liquidity continues to drive transaction volumes and support asset valuations,” it said.

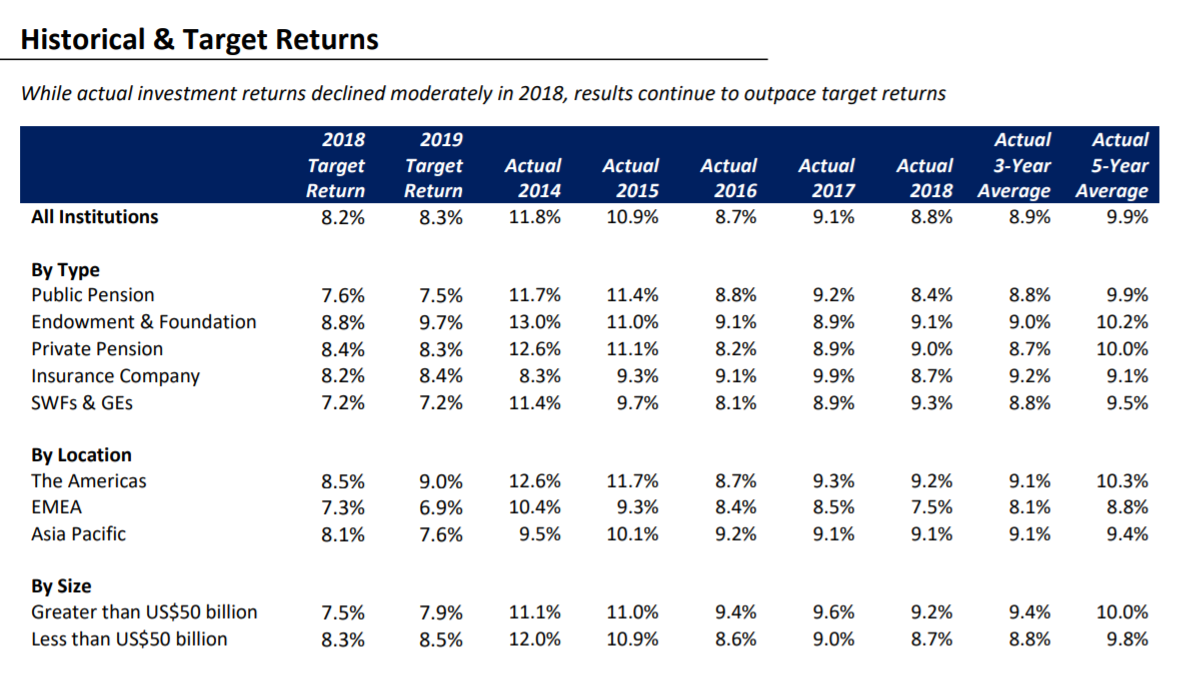

Moderating Returns

As capital appreciation has slowed in recent years, returns have moderated to high single digits, according to the report. Institutions reported an average return of 8.8% in 2018, down 30 bps from 9.1% in 2017. “While institutions continue to express concerns regarding asset valuations and weakening economic growth, operating fundamentals remain broadly favorable which is contributing to a continuation of strong returns for the asset class,” the report said.