Products You May Like

2020 budget planning, a rite of October, now reaches a truth-or-dare moment as a critical path priority for housing’s big and small business players players. Real money’s at stake, tons of it. The fates and fortunes of firms hinge on superior skills at matching who they are, and how they invest, with what will come next. Self-contradictory signals shroud the near term in uncertainty, second-guesses, erratic shifts, heightened risk, and doubt. Investment decision-makers abhor volatility and unpredictability. Still, there we are—there’s no avoiding it.

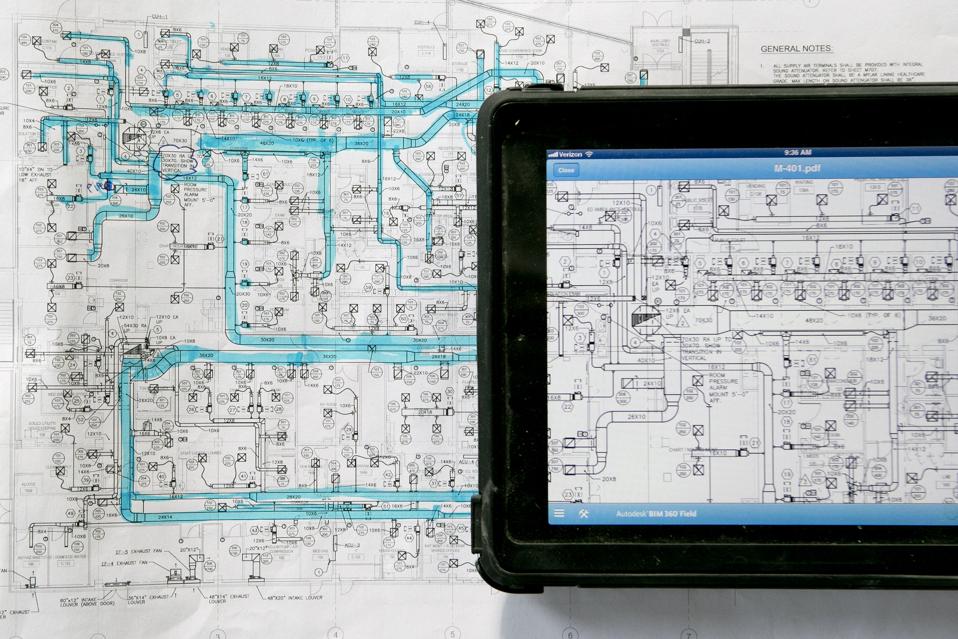

An Apple Inc. iPad displays Autodesk Inc. architectural drawings next to paper blueprints in this arranged photo at a Skanska USA Building Inc. Inova Health System construction site in Lorton, Virginia, U.S., on Thursday, Jan. 3, 2013. The rolls of

BLOOMBERG NEWS

And what do residential construction business leaders tend to do when they realize they’re navigating unexplored regions? Instinctively, they grab trusty dusty old maps—is what they do, normally. They try to find their way via dead reckoning.

So, it’s an ideal moment to pose a question. Will an up-to-now robust pipeline of design, technology, and data-fueled start-ups and innovations wither on the vine as signs of toughening business conditions flare up as potential threats? What will come of disruptive, factory-based building technologies, brilliantly offbeat tiny house designs, single-family for-rent operational and financial platforms, multigenerational and sharing-economy living templates, and digital lending and transaction platforms, etc.?

Recently, proptech venture capital firm Fifth Wall announced having closed its second real estate technology fund, a $503 million treasure trove, with 50 bluechip limited partner investors, including Lennar, D.R. Horton, Pulte, and Toll Brothers. The convergence between a defining future and an ever-beckoning comfort zone in the past sets up a dilemma of unprecedented urgency. It’s estimated that venture capitalists are pumping $1 billion a year in new investments into the prop tech space, and builders have been keen on getting in on the ground floor of these opportunities.

How prone are these would-be innovation investment sea-changes to elimination or resource-deprivation, as veterans of housing cycles-past overlay tried-and-true, back-to-basics tactics, assumptions, and safe-haven bets as 2020 and 2021 budget expense and revenue guardrails?

Innovation Double-Down

Construction industry investment banker Margaret Whelan has picked up a “this time’s different” vibe for innovation investment, she firmly believes that old ways won’t open new doors. Her eponymous advisory firm’s clientele operates at a bustling crossroads of Wall Street institutional investors, venture capitalists, Silicon Valley insurgents, friends-and-family finance, old school home building operators, and a disrupt-able supply chain of building materials enterprises. Her view is of a juncture when fortitude and further investment is not only needed, but gaining traction on some of housing’s wicked problems—such as labor shortages, lagging productivity, and surging costs. Whelan’s spidey sense is that, while under normal circumstances innovation might get put on an untimely hold, home building enterprises may have reached a no-going-back inflection point. Why?

“The investments being made are meaningful,” per Whelan, noting that $3 of every $5 dollars of upwards of $10 billion in capital raises in real estate tech and development over the past 12 months have been Series A funding for entrepreneurial, out-of-the-box start-ups, with participation by an increasingly wide range of investors. Further, Whelan says, supply chain behemoths with broad geographical infrastructure, like publicly traded LP Building Solutions and BMC, have re-tooled, restructured, and invested in cutting complexity out of home construction’s baroque workflows and inefficient value chains.

“The national builders are run by seasoned management teams who are starting to embrace the opportunity that technology provides, and that consumers are expecting,” says Whelan. She argues that up-and-coming household decision-makers do and will value precisely-crafted, energy-positive, waste-reducing new homes produced largely in factories, rather than by 25-plus separate trade crews on home sites. “I believe that these young, affluent, educated millennials care about their carbon footprint and they don’t want to see so much waste. They appreciate the precision that 3D designed and factory-built houses offer, along with the faster delivery times and lower utility bills. Being customer focused gives you pricing power, so it is encouraging to see some of the publicly traded builders with permanent capital make direct investments in new world providers, or indirect investments in housing related venture capital funds; and it’s important that their boards give them time and support to make this happen.”

Innovation costs money, time, and talent—each a form of capital investment that tends to tighten up as builder business execs batten down the hatches in advance of heavier economic weather. What’s more, that capital often needs patience to bear fruit.

How can you tell the difference between innovation commitments big and little builder, developer, manufacturer, and investor stakeholders may let fade as fair-weather fads versus ones likely to endure a cyclical downshift and destined for widespread impact?

Perhaps by taking a look at the root impetus underlying each of five “tent-pole” opportunity areas of investment in structural transformation. This way, we can detect which initiatives reflect structural change, and which may be passing infatuations that may become casualties of more cautious budgeting.

Eve of Disruption?

Root issues are two-fold: One, a chasm separates stagnating household wages from soaring housing expenses. The other is construction’s crippling skilled-labor challenge, which limits output, piles on costs, and adds unpredictability. “Four Horsemen” firms are odds-on favorites to disrupt home building’s incumbent top 10 corporate enterprises. They include Maryville, Tenn.-based Berkshire Hathaway unit Clayton Homes, Softbank Vision Fund-backed Katerra, Amazon—a disrupter of all things for-sale or rent, and Japan-based Sekisui House, the world’s number one home builder and developer. Each possesses wherewithal and DNA to attack vertical construction’s Gordian knot of cost structures, which represent over 50% of a home’s total costs. The challenge is when—not if—one or more of them finds opportunity on the lot development, acquisition, and local fees cost basis, which account for another 25% to 35% of each new unit of residential construction. The potential here is to restore homeownership “attainability” to middle-income working households by bringing down the barriers to entry level, massively expanding the addressable market universe.

Time-line:

Within 24 to 48 months, at least three out of four of the key disrupters will have secured a presence within America’s top 10 home building enterprises, with two of them owning top 5 market share of new home construction. The ultimate disruption, by 2030 or so, is home structures and communities as a service, offering a membership-model suite of well-being, entertainment, and health solutions to individuals and families, for new or existing housing.

Single Family For-Rent vs. For-Sale?

Three root-cause forces propel the single-family built-for-rent late-recovery juggernaut. One, household formation’s confluence of rent-by-necessity and rent-by-choice households that opt for four-walls-and-a-back-yard instead of vertical apartment neighborhoods. Two, builders’ and developers’ land- and construction-cost basis can be lower on a square-foot basis than urban vertical development, thanks to lower land expense, fewer building and engineering challenges, and standardized floor-plans and building schedules; not to forget that these homes tend to run smaller by 35% or more. Three, data and technology improvements to scattered and clustered property management give owners a cleaner, clearer, more efficient cash-flow model. Irvine, CA-based AHV Communities, the number one pure-play disrupter in the space, has mapped a consumer-centric operational model that home builders have taken notice of and are racing for a build-for-rent position in masterplanned communities around the nation.

Time-line:

As builders push to “turn” and monetize more of their fully-owned lot inventory in advance of an anticipated deceleration in the market, the appeal of building units in an even-flow cadence and making them available for rent rises. We see the single-family built-for-rent segment rising from current levels of 5% of total new-home volumes to double-digit share during the next 48 to 60 months, and reaching a steady-state between 10% and 15% of new-home construction in the next decade. Comments Whelan, “The SFR operators, this industry and asset class that emerged out of the correction 10 years ago, are softening the bottom in a lot of markets. That’s because these established real estate REITs, with large market caps and access to capital, are buying spec homes and sitting inventory from spec builders, local builders, public, and private builders around the country.”

The Square Footage Riddle:

Tiny houses likely will never gain more than a fringe toe-hold in total home construction. However, smaller homes—ranging from less than 1,500 square feet of conditioned living space to 2,200 square feet, both attached and detached—are cropping up in the current product offering vernacular of more and more locales. Going back to the No. 1 root-cause driver, the intent here is to reboot America’s “starter home” category, attainable to households with middle- and lower-middle incomes. A corollary cause here is a fundamental reset of consumer expectations around indoor space and function, and the advance of building and home technologies capable of “expanding” livability. The result is people are trading off square footage for solutions that add up to sanctuary, privacy, security, noise abatement, etc., as well as attainability, reflected in lower total costs of lifetime ownership.

Time-line:

Entering and coming out of the next housing cycle, the demographic near-future—family-forming Millennials and aging Baby Boomers—will continue to redefine square footage. One in three new, for-sale homes clocks in at under 2,000 square feet today, give or take. Within 36-to-48 months, we see that number increasing to nearly 50%, both for economic reasons, and because 5G technology and design advances change the way each square foot of sheltered and outdoor living space lives. The

Friction-Free Flip

The pain of buying a home can be compared to few other excruciating human experiences, one of them being the anguish, for many, of selling a home. IBuyers—Opendoor, cataList, Knock, Offerpad, Keller Williams, Perch, Redfin, Ribbon, and Zillow, etc.—have made quick inroads and sudden impact in the deft calculus of patient capital, algorithms that match supply to demand, and elegant user-experience that trade pain removal for a tolerable price. Many players in the space will likely winnow to a few, and what distinguishes winners from losers would be the heft and scale to profitably offer a service suite—purchase, sale, remodeling and renovation, and insurance, with margin opportunity at each level of service.

Time-line:

Currently a “fringe” opportunity that accounts for upwards of 5% real estate transaction activity in select markets where iBuyers are active, the model is nascent, but gaining traction thanks to the convenience and timing benefits it offers motivated buyers or sellers. The capital commitment, data and user experience investment, and construction infrastructure it will take to scale mean that iBuyers won’t become an overnight phenomenon. However, given the dynamics, particularly of the mammoth Baby Boom generation aging from “active adult” to less active living-in-place households, both the demand and the dollars suggest a 48- to 72-month horizon for this business and operational model to reach critical mass. At that time, a mid-teens percentage share of residential real estate transactions—and an entirely disrupted and disintermediated real estate agency and brokerage business—are in the offing. We see home builders following Lennar’s venture investment in Opendoor, similar to their core business focus on owned mortgage finance businesses for their buyer prospects.

Home Economics On Steroids

Just as the mechanisms to buy and sell homes undergo transformation, so, too are home floorplans, and the way they can and must change. Physical living space and its function in homes now goes well beyond “flex space,” literally, in mapping to real-time adaptations, and morphing over time to the evolving lifestyle needs of residents living in them. Household economics and demographics underpin this trend, and job and family formations during the slow economic recovery cycle have accelerated it, even as short-term rental giant Airbnb and a number of accessory dwelling unit businesses create models and introduce applications. Meanwhile, builders are investing in flexible modular additions, moving walls, connected in-law flats, ADUs, all as household composition, demographics, and economics reflect faster rate of change.

Time-line:

Floor-plans that set up for multi-generational living, revenue units, modular moving walls, and the pervasive focus on indoor-outdoor living all reflect shifts in how consumers want to live in their homes. At the same time, duration rates for people in their homes have begun creeping up in more and more locations. Nimble, agile, and flexible floorplans are part of the repertoire of most home builders’ product line-ups these days, and the investment in these adaptations will continue to grow as households and communities evolve.

To twist a phrase, sometimes the worst defense is choosing to play no offense. It seems the home builders know that move—playing all defense—by heart, and are choosing to look differently at more adverse conditions ahead.